KYC as a Service: Meet German KYC requirements

Take control of your compliance processes with S+P KYC Service. By letting us take on the tedious task of customer identification and verification, you can focus your resources where they are needed most. Trust in our expertise and make KYC our business.

- Efficiency through outsourcing: Let us take over the time-consuming task of KYC checks so that you can focus on your core business.

- Expertise and experience: Benefit from our many years of experience and expertise in conducting KYC checks.

- Security and data protection: We strictly adhere to data protection regulations and use the latest security technologies to ensure that your customer data is safe.

- Compliant without the headaches: We keep you up to date with the latest regulatory changes, so you are always compliant with the latest KYC requirements.

S+P KYC Service: Your partner for KYC and due diligence services

S+P KYC Service offers a comprehensive, outsourced solution for Know Your Customer (KYC) compliance requirements. With our expertise and innovative technology, we simplify the KYC process, protect your customer data and help you to efficiently comply with regulatory requirements.

213 €

single tier UBO structure

371 €

two-tier UBO structure

539 €

three-tier UBO structure

Customized

multi-level complex UBO structures

S+P VideoIdent – Meeting German Regulatory Standards

S+P VideoIdent is an ideal solution for low volume cases that require accurate and secure identity verification. Our service allows you to efficiently and reliably confirm the identity of your customers via video identification. In doing so, we comply with all relevant data protection and KYC regulations, including the requirements of BaFin. With S+P VideoIdent you can rest assured that your process is both secure and compliant.

44 €

per videoident

up to 100 cases

31 €

per videoident

101 to 1,000 cases

18 €

per videoident

1.001 to 1.500 cases

Customized

per videoident

greater than 1.500 cases

Simple, secure, efficient – your global solution for KYC compliance.

Make an inquiry

Simply contact us to discuss your specific need. We are here to help you and find the best service for your needs.

Offer received

Based on your request, we create an individual offer that is tailored to your needs. Our goal is to offer you the best possible solution at the best price.

Conclude an outsourcing agreement

The outsourcing agreement ensures compliance with all regulatory requirements and ensures that you receive the best possible service.

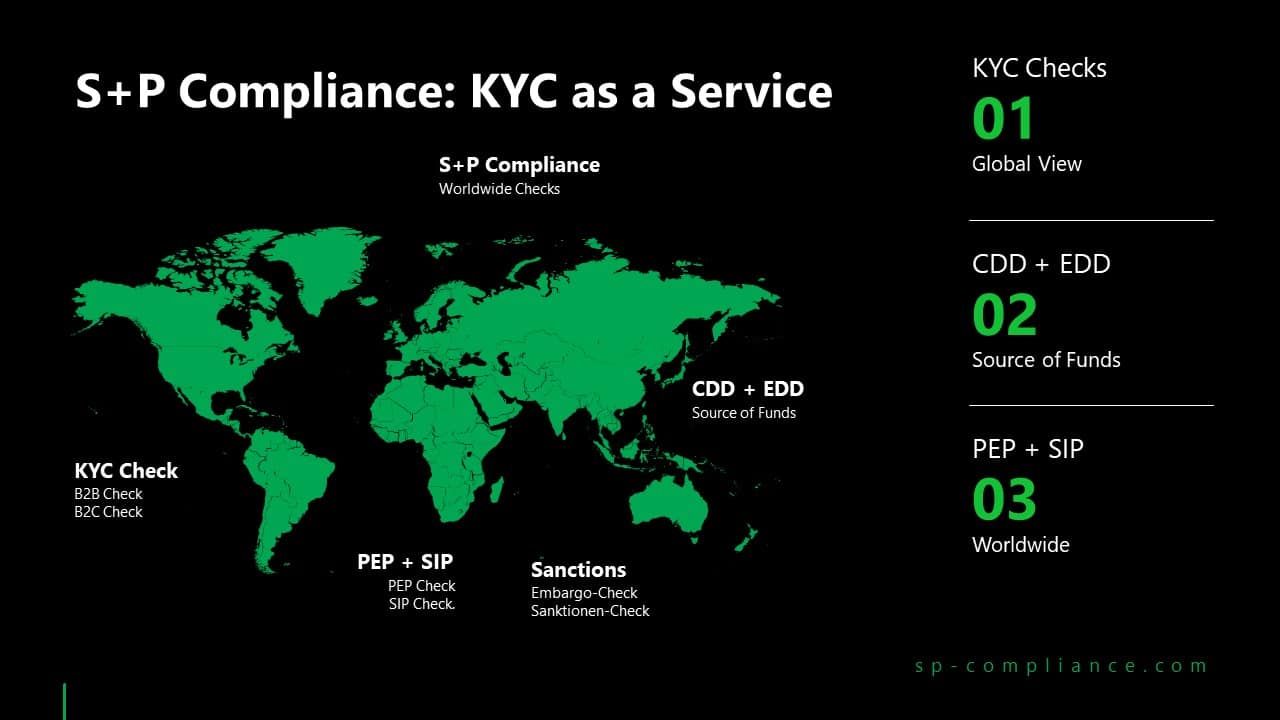

S+P KYC solutions: Your global partner for comprehensive KYC compliance.

In the complex world of regulatory compliance, the S+P KYC service offers a simple, secure and efficient solution. Our service is specially designed for global KYC checks, multi-level UBO structures and compliance with EBA guidelines. Benefit from our B2B expertise and make KYC our business to focus on your own.

Global KYC checks

With our service, you can seamlessly perform worldwide KYC checks, relying on our extensive databases and resources.

B2B-Expertise

Our team has extensive experience in B2B KYC verification and understands the unique challenges and requirements of this particular category.

Multi-level UBO structures

We support complex and multi-level UBO structures that require accurate and detailed due diligence.

Risk classification

We strictly adhere to the EBA guidelines and ensure careful documentation of risk factors as part of your KYC checks.

Security and Privacy

We ensure the security of your customer data with our strict data protection guidelines and state-of-the-art security technology.

Time and resource efficiency

By taking over the tedious task of KYC checks, you save valuable time and resources that you can invest in your core business instead.

Concentrate on your core business – we take care of your KYC compliance!

-

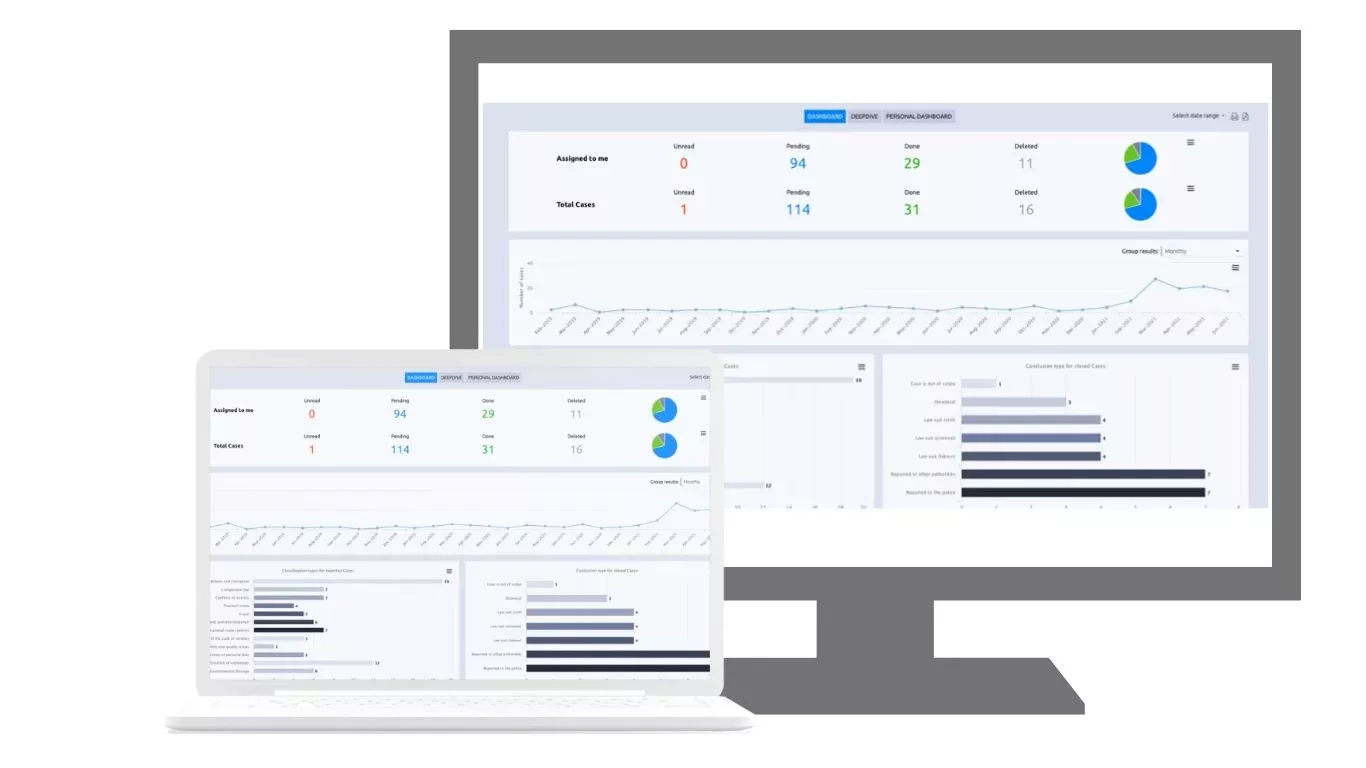

Digital documentation: The S+P KYC Service enables complete digital documentation of all KYC checks. This not only simplifies the process, but also ensures that all important information is stored safely and within easy reach.

-

Audit Trail: With our service you have a complete audit trail of all KYC checks carried out. This provides clear traceability and facilitates compliance with regulatory requirements.

-

Security and Compliance: The S+P KYC Service offers a secure platform for conducting KYC checks and documenting processes, while strictly adhering to all relevant data protection and compliance regulations. This gives you the assurance that your KYC processes are secure, efficient and compliant.

S+P KYC Service: Your trusted partner for customer identification

The S+P KYC Service offers a secure, digital solution for KYC checks, with comprehensive documentation and a continuous audit trail, which makes compliance easier and more efficient.

FAQ: Your questions, our answers!

-

What is the S+P KYC service?

The S+P KYC service offering is a comprehensive, outsourced solution for Know Your Customer (KYC) compliance requirements. Our service simplifies the KYC process, protects your customer data and helps you to efficiently comply with regulatory requirements.

-

What advantages does the S+P KYC service offer?

The KYC service offers several advantages, including the performance of global KYC checks, B2B expertise, support for multi-level UBO structures, documentation of risk factors according to EBA guidelines, improved security and data protection, and time and resource efficiency.

-

How can I book the S+P KYC service?

You can book the KYC service in three simple steps: First, make a request. Secondly, you will receive an individual offer. Third, enter into an outsourcing agreement.

-

Who can use the S+P KYC service?

The S+P KYC service is ideal for any organization that needs to ensure compliance with KYC regulations, especially companies with global customers, complex UBO structures or specific B2B requirements.

-

What measures does S+P take to ensure the security of customer data?

At S+P we take the security of your data very seriously. We strictly adhere to data protection regulations and use the latest security technologies to ensure the security of your customer data.

-

How does the S+P KYC service keep up with the constantly changing regulatory requirements?

At S+P we have a team of experts constantly monitoring the latest regulatory changes and industry best practices. This allows us to continuously adapt our services and ensure that they always comply with current regulatory requirements.